Futa suta calculator

SUTA otherwise known as the State Unemployment Tax Act was created in parallel with the Federal Unemployment Tax Act FUTA in 1939 to help reinvigorate the US. The federal FUTA is the same for all employers 60 percent.

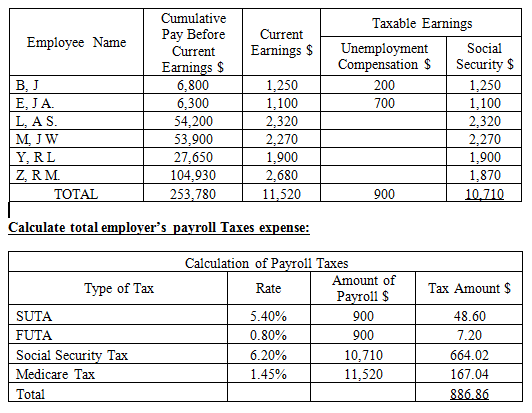

Solved Calculation Of Taxable Earnings And Employer Payroll Taxes Chegg Com

Ideally the unemployment tax is.

. Both FUTA and SUTA calculate as follows. Its a payroll tax that many states impose on employers in order to fund state unemployment. The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance.

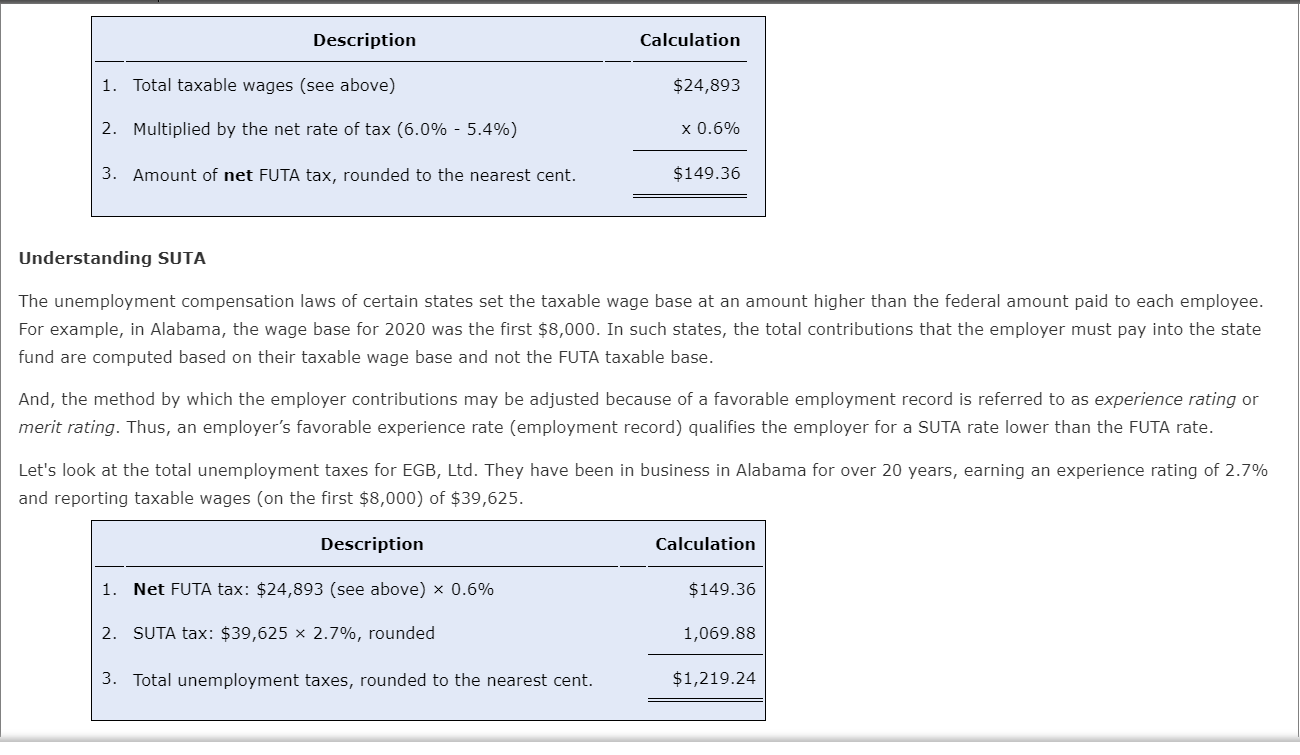

For state FUTA taxes use the new employer rate of 27 percent on the first 8000 of income. If you paid wages subject to state unemployment tax you may receive a credit when you file your Form 940. The standard FUTA tax rate is 6 so your.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. FUTA Tax per employee 7000 x 6 006 420. Note that 7700139 is 10703 but the statutory limit is 10700 rounded to the dollar.

Of course if you want to allow for. Thus the max SUTA in Mar is 3055 not 3058. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

Heres how you calculate the. Heres how an employer in Texas would calculate SUTA. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year.

The State Unemployment Tax Act SUTA is essentially FUTA on the state level. Heres how an employer in Texas would calculate SUTA. Social Security Tax.

Take the following steps to apply for a SUTA account though the. When calculating FUTA taxes it is important to understand the kinds of incomes that need to be taxed. Who pays FUTA taxes.

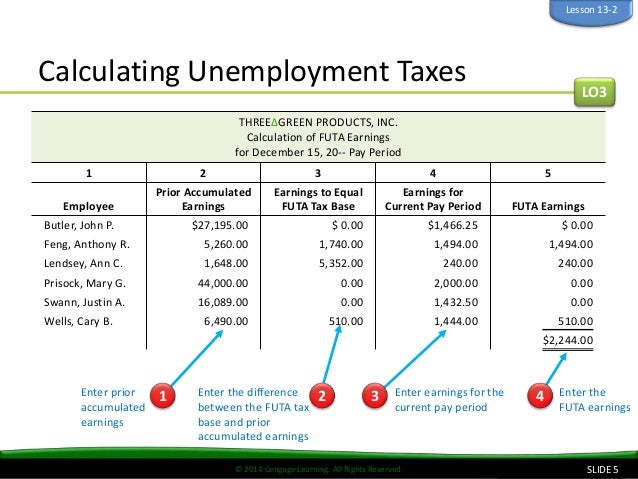

A FUTA payment is calculated based on 08 of the first 7000 of employee wages in each tax year which is actually comprised of a 62 tax. The system looks at each transaction in the Payroll Transaction History table UPR30300 that are subject to FUTA. To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees.

FUTA Tax per employee Taxable Wage Base Limit x FUTA Tax Rate. If the pay code. Add up the wages paid during the reporting period to your employees who are.

Your state wage base may be different. Heres a breakdown of how to calculate your quarterly FUTA liability in this scenario. The FUTA tax rate is a flat 6 but is reduced to just.

To start paying SUTA tax you need to set up an unemployment insurance tax account through your state. To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees. How to Calculate the FUTA Tax.

How to Calculate FUTA Tax. The states SUTA wage base is 7000 per.

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Need An Excel Formula To Calculate Suta Tax On Monthly Wages With A Microsoft Community

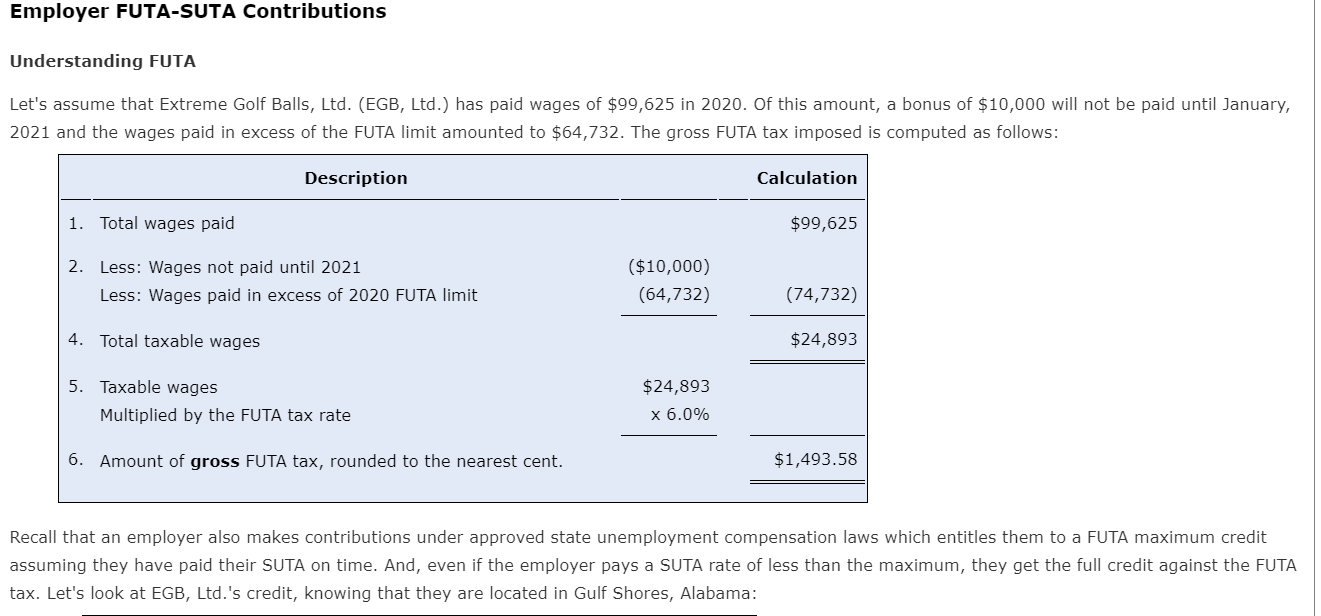

Employer Futa Suta Contributions Understanding Futa Chegg Com

Payroll Tax Calculator For Employers Gusto

How To Calculate Taxes On Payroll Factory Sale 56 Off Www Ingeniovirtual Com

Calculating Futa And Suta Youtube

Solved Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

Calculating Suta Tax Youtube

Futa Tax Overview How It Works How To Calculate

Employer Futa Suta Contributions Understanding Futa Chegg Com

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Need An Excel Formula To Calculate Suta Tax On Monthly Wages With A Microsoft Community

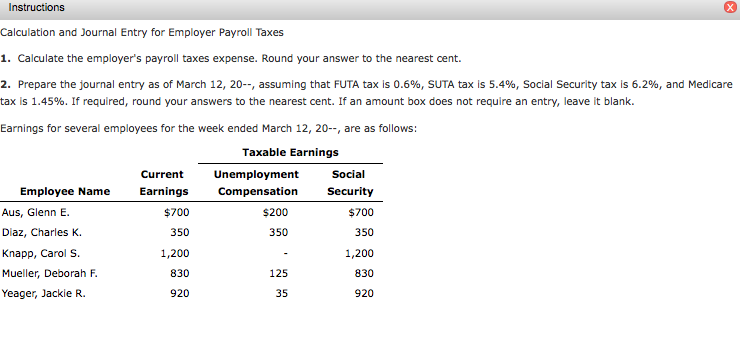

Solved Instructions Calculation And Journal Entry For Chegg Com

What Is The Federal Unemployment Tax Futa Cleverism

Formulate If Statement To Calculate Futa Wages Microsoft Community

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks